The 420 Minute Presents: Up in Smoke: Don't let compliance burn away your profits

The

420 Minute Presents: Up in Smoke: Don’t let compliance burn away your profits

By:

Sarah Mulcahy

Alright,

folks. Welcome back to the 420 Minute after an extended high-atus (I know, I

know. Even when attempting professionalism, I can’t resist a stupid pun).

I’m

broadcasting to you today after an extra-long camp. Someone finally said “Hey,

are you passing that?” and I responded with “Every class.” But enough about me

and my 4.0 (Yes, I’m bragging, get over it. I worked my butt off.). We’re here

to talk about cannabis and, gulp, accounting?

I

can hear your brains crashing and rebooting from here. Calm down, my pretties. Math

is your friend. But this isn’t about numbers and figures, folks. And proper

accounting is an integral part of our favorite botanical blessing.

That’s

right. Marijuana is dependent on accounting. No accounting, no legal weed

industry.

No

legal weed industry would mean the absence of my friendly, neighborhood

budtenders at Satori

South. Not to mention the other 200,000+

superheroes across the nation working in the legal-cannabis industry. You know,

the ones who rely on accurate and appropriate accounting for their livelihood.

So,

keep reading. There is something you can do to help legitimize this industry. And

I promise, I’ll do all the math.

“‘Tis

but a scratch!”

As

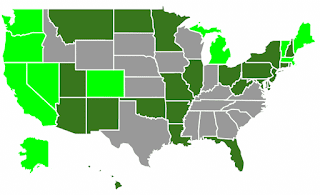

I’m typing this, 33 states and our nation’s capital city (seriously D.C.? Soooo…legislators

can smoke up while their constituents get jail time???) have legalized cannabis

in some fashion. Plus, Canada is running out of

legal weed since countrywide recreational cannabis sales went into effect in

October. And we’ve barely scratched the surface of cannabis legalization.

Information is current

as of Nov. 7, 2018.

|

| Map from governing.com |

If

recent statistics and predictions prove true, cannabis legalization will become

more common, not less. As a result, cannabis-business owners and finance

professionals, such as accountants and tax preparers, will need to work

together for the benefit of this booming industry.

Not

to mention the benefit of all the taxpaying, voting citizens that want

legalization.

So,

how do these two industries take advantage of the mutual benefits while abiding

by their respective state and federal regulations? 1)Use proper accounting

methods; 2)Take precautions with industry clients; 3)Follow state and federal tax

regulations; 4)Contact legislators on a regular basis.

“‘1, 2, 5!’ ‘3,

sir!’ ‘3!’”

Use the right methods in the right way.

This is the most important thing for cannabis-business owners and anyone they

entrust with keeping track of their money and inventory.

Proper

inventory and bookkeeping methods are especially important because of the cash-only

basis of these companies.

Find

cannabis-industry specific

CPAs and tax advisors to guide you through the legislative quagmire. I

recommend discussing the accrual

method as well as a perpetual

inventory system. And if we’ve learned anything, as a society, from Al

Capone, let it be this: Always Pay Your Taxes!

|

| Photo by: S. Mulcahy |

“It’s

only a model.”

Certified

public accountants are held to strict codes of ethics and morals. However, each

must decide individually if cannabis accounting violates these codes, or if it

might be considered in violation of the state accountancy board code of

conduct.

And

once the leap is taken, CPAs must protect their own assets in addition to

providing quality service. Accurate record-keeping and transparency are key

elements, but cannabis accountants also need to investigate potential clients

and both parties need to agree to total compliance with state and federal

regulations.

Luckily,

a handful of state accountancy boards (like Washington, yay Washington! – yes,

I’m biased, but I love Washington) have released statements acknowledging the legal

cannabis industry. However, the advice is essentially: “We won’t stop you, but

the feds might, so beware.”

Basically,

do the footwork, stay current on cannabis legislation, and guard yourself as

best you can when entering the cannabis industry as a CPA.

“Help,

help! I’m being repressed!”

I

know you don’t want to hear it, so I won’t say it…I’ll type it. Follow the

rules! This may seem completely obvious, but I’ve worked enough retail and

production jobs to know that this is not something better left unsaid (or

untyped as the case may be). I’m sure most of you have worked with people, or

for companies, that cut corners or ignored regulations.

This

is not the industry for that kind of behavior. Not if the industry wants to

gain legitimacy.

Complying

with state and federal regulations needs to be the top priority of cannabis

businesses. Don’t let your Durban paradise (did I just create a strain name!?)

become a pipe dream. I know the complexities of all the rules and regulations

can feel like the accounting equivalent of a Rubik’s cube (more like a Rubik’s

dodecahedron! That’s a joke for the nerds).

But

you don’t have to solve the puzzle alone. There are many experts willing to

work with cannabis-industry businesses. They can help find solutions to

maximize profits while maintaining compliance with state and federal

regulations.

“Message

for you, sir…”

The

people are speaking. The aria is being sung. Prohibition must end. All this

state-by-state legislation is wonderful (at this rate, marijuana will be legal

in all 50 states before it’s legal in ‘all 50 states’), but it is time to sit

the federal government down and have ‘the talk’.

And,

just in case some of us forgot, the federal government doesn’t hold the power.

We the people do. It is time to start talking in ways that our legislators can

understand (I mean, you’d think voting to approve legalization in three-fifths

of the country would be enough, but who am I to judge?).

It

is time to contact

our legislators and demand fair,

federal cannabis reform. And remind them where the power in a democracy

truly lies: with the will of the people.

And

if those in office refuse to listen, then we, the people, have the power to

elect legislators who will hear what the people are saying.

If you like what you read, or you're interested in cannabis legalization news or strain reviews follow us here and on Instagram @the420minute. Until next time, folks, remember to keep calm and smoke on!

And pay your taxes!!

Comments

Post a Comment